Wage subsidy

A wage subsidy is a payment to workers by the state, made either directly or through their employers. Its purposes are to redistribute income and to obviate the welfare trap attributed to other forms of relief, thereby reducing unemployment. It is most naturally implemented as a modification to the income tax system.

The wage subsidy was proposed by A. C. Pigou in his 1933 book The Theory of Unemployment.[1] It was subsequently advocated by American economists Edmund Phelps[2] and Scott Sumner,[3] by American policy advisor Oren Cass,[4] and by British economist Tony Atkinson under the name of participation income.[5]

The wage subsidy differs from universal basic income (UBI) in being limited in its scope to workers in paid employment, and does not generally seek to take the place of other benefits.

Properties

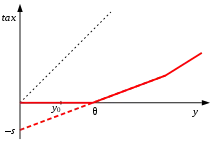

Income tax is payment made by the worker to the state as a function of his or her income. A wage subsidy is a payment in the opposite direction. It can be presented as a modification to the operation of income tax below its threshold. In a conventional system the tax payable on an income y may be shown by the solid red line in the diagram, where θ is the threshold. Under a wage subsidy the employee's contribution to the state might be shown by the broken line below θ, being negative for workers on low income. s is the amount of the subsidy.

Obviously the same system may be viewed as having a wage-independent subsidy and a tax payment increasing in a certain way, or as a subsidy which varies with income combined with a tax which varies in a different way.

It is not essential for a wage subsidy that it should be sufficient for a person to live on since no one is expected to live on it alone. If the pre-tax income of the lowest paid worker is y0 in the diagram, then the amount he or she has to live on is equal to the sum of y0 and the net amount the worker receives from the state through the tax/subsidy system; non-workers, on the other hand, are assumed to receive benefits determined separately. This is in distinction from UBI in which the subsidy element is identified with the benefit paid to non-workers, and in which therefore the lowest paid worker receives enough to live on from the state and a further sum determined by his or her economic value to his or her employer. The increase in income from taking paid work may be more than is needed for incentive purposes.

In order that people should be motivated to take work and not feel demeaned by the compensation received, it is desirable that the post-tax income of the lowest paid worker under a wage subsidy system should be appreciably greater than the benefit he or she would receive when out of work. However it would probably be less than the income the worker would receive under UBI; accordingly a wage subsidy system would impose a lower tax burden than UBI, which is the main reason for the preference shown for it by some authors.[5]:217–8

A wage subsidy is well suited for implementation through the income tax system since its intended recipients are workers who are expected to be registered with the taxation authorities.[4]:8 It has been suggested that UBI should be implemented by the same means, which requires non-workers to also register and accounts for Friedman's choice of the name 'negative income tax' for his UBI proposal.[6]

Relationship to universal basic income systems

If a society decides to pay a fixed stipend per capita, it has the choice of making the payment unconditional or conditional (usually meaning that it is limited it to people in work, varyingly understood), and of making a full income payment (i.e. enough to live on) or just a partial subsidy (which needs to be supplemented by income from another source). Most governments do none of these things, but instead pay benefits in cases of need. The options can be illustrated in a diagram.

| full | partial | ||

| unconditional | full basic income |

partial basic income |

|

| conditional | ? | wage subsidy |

|

| tax and benefit |

The cell with a question mark has no agreed name but has certainly been discussed.[5]:218 Different arguments can be put forward for the various moves from cell to cell which can be made in the diagram; generally movement on the left-right axis is more significant than movement up/down.

Outline of the operation of the wage subsidy and related systems

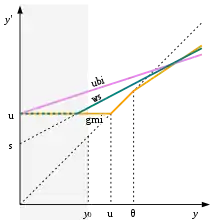

The graph shows the take-home salary y' for a worker as a function of the wage y' an employer would be willing to pay him or her for his services; y' is y adjusted for all taxes, benefits and subsidies and for any state-funded basic income. We use a simplified model ignoring such complexities as child benefits and collective bargaining. The wage a worker commands can be identified with his or her marginal productivity.

We let u be the cost of living at what society considers to be the minimum reasonable standard, and assume that both unemployment benefit and UBI would be set at this level. Guaranteed minimum income may be considered as equivalent to unemployment benefit for the purposes of this discussion. As before, we let θ be the income tax threshold in a conventional system and let y0 be the marginal productivity of the least employable person in the workforce (excluding extreme cases). If y0>u the market can be left to itself since no one will suffer undue hardship.

More reasonably we shall assume that y0<u. We can ignore the part of the graph to the left of y0 since it is essentially unpopulated (except for people electing to take y=0). The important property of any function specifying in terms of y is its gradient: a steep function gives the worker an incentive to work, and a flat function takes the incentive away. Ideally we would like the function to be as steep as possible everywhere,[7] but since redistribution is the only tool at our disposal, an operation which steepens the function at one point is likely to make it less steep somewhere else.

So consider first the working of a conventional tax-and-benefit system shown by the orange line ("gmi"). A worker whose value to his or her employer lies between u and θ will take home exactly what he earns, receiving no benefits and paying no taxes. When the pre-tax salary increases beyond θ the take-home salary will increase less than pro-rata because of the deduction for tax.

The difficulty comes for a worker whose economic value is less than u. Such a worker would have the choice of taking employment giving an income less than u on the 45° line in the diagram, or of going out of work so as to take a larger income. The system makes it advantageous to choose the latter option, so the part of the workforce between y0 and u is likely to be unemployed. This is reflected by the flatness of the orange line in the diagram.

Now consider a UBI system illustrated by the purple line. It is never flat, so people always have an incentive to put in more work. But it is also very gently inclined so that workers may feel that additional effort is insufficiently rewarded. This is a consequence of the fact that the function is much higher at y0 than the alternative systems, and that the money to fund it here has to be taken through the marginal taxation rate. Critics of UBI have attributed significant disincentive effects to it on this account.[8][9]

Finally consider the green line showing the working of a wage subsidy. This is flat at the left, but its flatness here is harmless since this part of the graph is unpopulated. Over the rest of the range it makes a compromise between the conventional system and UBI.

The involuntarily unemployed receive an income of u in all cases.

Not shown in the graph is the treatment of people who are voluntarily out of work ('surfers',[10][5]:221 and also people performing unpaid domestic roles). Under UBI they would receive the y'basic income u; under a conventional tax-and-benefits system and under most forms of wage subsidy they would receive nothing. Under Atkinson's 'Participation Income' some unpaid activities (such as voluntary work and housekeeping involving the supervision of children[5]:219) would receive s. This is the sole difference between Atkinson's system and other forms of wage subsidy.

The behaviour of y' as a function of y in the vicinity of y=y0 may be taken as the defining feature of a wage subsidy system.

Partial basic income

A wage subsidy is equivalent to a system in which the payment u to unemployed workers is broken down into the sum of a partial basic income (PBI) s and an additional benefit u–s; the take-home pay of employed workers will then be the sum of s and a proportion of their pre-tax wage. A partial basic income is paid to surfers and others choosing to stay out of employment, but its effect on people working or seeking employment is exactly the same as that of a wage subsidy.

Advantages claimed

As a cure for unemployment

This is the original motivation. According to the classical theory of unemployment, unemployment is the consequence of distortions of the labour market at the low end of the salary range. A worker will be taken on by an employer so long as his or her economic value is greater than the cost of employment (which lies largely in salary costs but has other components). Distortions often operate to prevent the payment of wages lower than some fixed value with the result that potential workers whose value to their employer would be less than this are left unemployed. Removal of the distortions would eliminate the problem, but would not be socially acceptable because the lowest wage a worker could command might not be enough to avoid starvation,[11] or at least might fall below the minimum considered an acceptable standard of living.

Advocates of the wage subsidy claim that it would allow the lowest paid workers to receive an adequate net salary even if their economic value to their employers was less than the socially acceptable minimum, and that their post-tax salary could exceed unemployment benefit by a sufficient margin for them to have an incentive to take work. The subsidy would thus obviate the welfare trap, but might have less effect against a wage minimum imposed through collective bargaining since trades unions might respond to the measure by increasing their demands. (Pigou evidently hoped that this wouldn't happen since he hypothesised that 'the wage stipulated for by wage-earners' would be 'reduced from w to (w–s)'.[1]:168)

The effect on unemployment was Pigou's sole reason for considering the wage subsidy. He discussed the case in which it was limited to particular industries, but nothing he said precluded its more general application. He concluded that 'It is obvious that... the quantity of labour demanded must be increased in consequence of this type of subsidy'.[1]:126

As a means of redistribution

The subsidy s is a form of negative taxation. The distribution of income produced by the free market has no claims to optimality, so it is generally accepted that social wellbeing is maximised by providing negative taxation at some level.[12] The wage subsidy provides a systematic way of doing this within the workforce. Since it can be implemented through the taxation system, it avoids the stigma attached to benefits which is often considered to limit their effectiveness.[5]:211 Atkinson seems to have favoured the wage subsidy purely for its redistributional properties.

UBI provides a more general solution since it goes beyond the workforce, but is less flexible because of the constraint that the subsidy component has to be enough to live on.

As capable of graduated introduction

There is no reason why a wage subsidy should not be introduced at a low level and gradually expanded. The same might be said of UBI; but some of the claimed benefits of UBI arise from the possibility of eliminating other benefits, and would not be realised by partial implementation.[6][8]

The consequences of automation

We have seen that under a standard tax-and-benefits system, if a sum u is paid to everyone who is unable to obtain work, then those people whose marginal productivity (which determines their wage in a competitive market) is less than u will prefer to be unemployed. The number of people affected will tend to increase through the introduction of automation. A recent study concluded that 'automation increases inequality in every scenario because it tends to displace the lowest-paid workers'.[13]

This is illustrated in the graph. The grey curve shows the distribution of the marginal productivity of labour through the workforce before the introduction of automation; the blue curve shows the same distribution after. The average marginal productivity is assumed to increase (the means are shown by the dashed lines), but the variance also increases, and the proportion of the workforce whose marginal productivity is less than u does the same (this is the area under each curve to the left of u).

It follows that a tax-and-benefit system may function as intended when first implemented, but that the introduction of automation may lead to an increasing part of the workforce getting caught in the welfare trap.

Other measures for relieving poverty

Minimum wage

The wage subsidy has the same redistributional properties as the minimum wage, but American advocates draw particular attention to the fact that it doesn't reinforce obstacles to full employment. Pigou (who wrote prior to the popularity of the minimum wage) shared their view of the harmful effects of artificially high wages. Atkinson (rather anomalously) simultaneously advocated introduction of a wage subsidy and increases in the minimum wage.[5]:250

It is not necessary to remove minimum wage legislation to implement a wage subsidy. So long as the minimum wage is interpreted as applying to the sum of the employer's payment and the government subsidy, its beneficial effects will be taken over by the subsidy and its harmful effects removed.

The minimum wage has the advantage that its funding line is invisible[4]:11 whereas revenue through taxation is conspicuous and often unpopular.

EITC

EITC is an American child benefit system with some similarities to the wage subsidy. It also provides a small credit for workers with no children. It has the surprising property that if two low-paid workers have different wages, the higher paid will receive the larger subsidy.[4]:8 Moreover the payments are made long in arrears.[4]:13

Eligibility criteria

One of the questions which arise connection with a wage subsidy is who would be eligible to receive it.[5]:220 The extreme case of unlimited eligibility makes no sense if unemployment benefit is retained; and if unemployment benefit is removed, it leads to UBI.

The criterion of being 'in work' is unsatisfactory on account of its flexibility. A married couple may comprise a breadwinner and a person who keeps house and is not conventionally paid. But if the breadwinner started to pay a nominal sum for the housekeeper's services, and if being in paid work was the eligibility criterion for the wage subsidy, then the couple would be enriched by the quantity s.[14] This subsidy does not further the aims of the scheme.

Atkinson, as we have seen, takes an inclusive view of eligibility whereas Phelps is exclusive, limiting the subsidy to the employees of 'qualifying firms' (and thereby excluding the self-employed).[2]:56

Any decision taken here runs the risk of arbitrariness, of enabling abuse or inducing perverse incentives, or of requiring an intrusive bureaucracy. Friedman's aversion to the last of these is one of his arguments in support of UBI.[6]

Notes and references

- A. C. Pigou, 'The Theory of Unemployment' (1933); see 'subsidies' in the index for mentions in the text.

- Phelps, Edmund S. (1994). "Low-wage employment subsidies versus the welfare state". The American Economic Review. 84 (2): 54–58.

- Sumner, Scott. "You can't redistribute income". www.themoneyillusion.com. Archived from the original on 11 August 2017. Retrieved 11 August 2017.

- Cass, Oren (August 2015). "THE WAGE SUBSIDY -- A Better Way to Help the Poor|Issue Brief 37" (PDF). Manhattan Institute for Policy Research. Retrieved 2020-08-13.

- Anthony B. Atkinson, 'Inequality' (2015).

- Milton Friedman, 'The Case for Negative Income Tax: a View from the Right' (1966).

- This is a simplification. It is not the purpose of economics to make people work as hard as possible, but rather to enable society to find the optimum balance between work and leisure, as between any two commodities. A reduction in work incentives is therefore not automatically a bad thing.

- "Negative Income Tax, by Jodie T. Allen: The Concise Encyclopedia of Economics | Library of Economics and Liberty". www.econlib.org. Retrieved 2020-08-13.

- E. F. Schumacher made a similar point. See Peter Sloman, 'Beveridge's rival: Juliet Rhys-Williams and the campaign for basic income, 1942-55' (2015).

- The shorthand 'surfer' to refer to someone who prefers leisure to paid employment is due to Philippe Van Parijs's 1991 paper 'Why Surfers should be fed: the Liberal Case for Unconditional Basic Income'.

- Mountifort Longfield, 'Four Lectures on Poor Laws' (1834).

- “Almost nowhere in the moral-philosophic literature is it deemed just that those [with low skills] should receive only [their] marginal product – no matter how low” – see the work cited by Phelps (p. 56).

- Sungki Hong and Hannah G. Shell (2018), The Impact of Automation on Inequality, drawing on estimates from Carl Benedikt Frey and Michael A. Osborne (2017), 'The Future of Employment: How Susceptible Are Jobs to Computerisation?' Technological Forecasting and Social Change, January 2017, 114, pp. 254-80.

- Housework is not included in the GDP. See a review by Adam Tooze.